It's Better in a Union

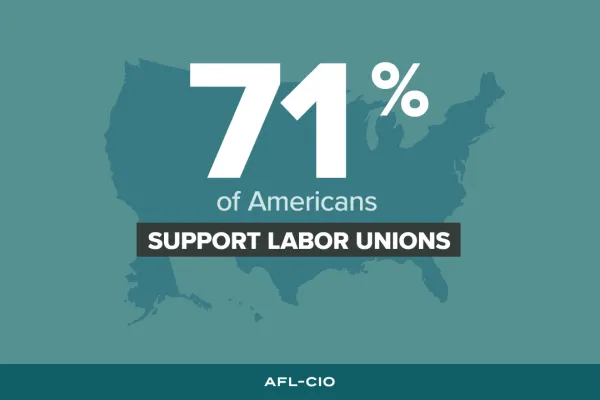

71% of Americans support unions, the highest level in nearly 60 years. And our future is bright: 88% of people younger than 30 support unions, too.

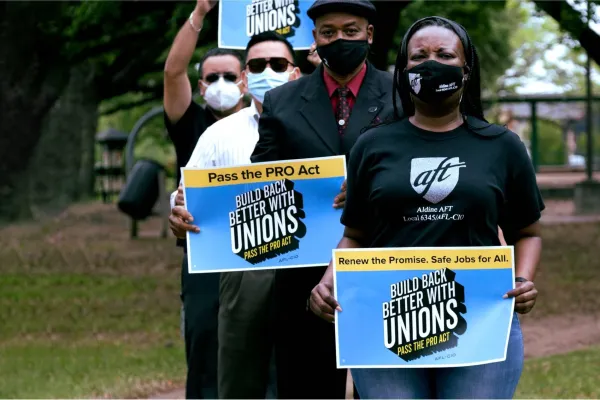

Building Power for Working People

How to form a Union in Your Workplace

Union Facts: The Value of Collective Voice

I'm Ready to Contact a Union Organizer

Featured News

AFL-CIO Stands with Rail Workers, Calls on Congress to Pass Paid Sick Days

News

AFL-CIO Stands with Rail Workers, Calls on Congress to Pass Paid Sick Days

AFL-CIO Stands with Rail Workers, Calls on Congress to Pass Paid Sick Days

Read More > AFL-CIO Stands with Rail Workers, Calls on Congress to Pass Paid Sick Days

Make a Difference in Georgia

National Apprenticeship Week

GET INVOLVED

Support NFLPA

NFL Players Need #SaferFields and Safe Working Conditions

NFL Players Need #SaferFields and Safe Working Conditions

Recent News

National Apprenticeship Week

71% of Americans Support Labor Unions

A New Way to File Taxes

Buy Union for the Holidays!

This Is the Story of How Workers Win

Protecting Workers’ Interests in the Tech Revolution

News

Protecting Workers’ Interests in the Tech Revolution

Protecting Workers’ Interests in the Tech Revolution

Read More > Protecting Workers’ Interests in the Tech RevolutionAFL-CIO News Feed

-

Service & Solidarity Spotlight: Minnesota Grocery Workers Reach Tentative Contract Agreement

-

The Fight Goes On: The Working People Weekly List

-

Service & Solidarity Spotlight: Volkswagen Workers Become First Southern Autoworkers to Win Their Union

-

Service & Solidarity Spotlight: Workers at Portland Hilton Secure New Contract After Two Years of Bargaining

-

SOLIDARITY ALERT: Sesame Workshop writers